I've been with GEHA HDHP for years. They're great until you actually have to use them for anything other than a routine visit. This year had been horrendous.

I needed a pricey prescription - denied, prior authorization required. Doctor submitted paperwork - denied, data missing. Doctor appealed stating data they wanted was right at the top of the paperwork they submitted - denied, doctor can't appeal, only policyholder can appeal. I wrote a letter stating the exact same thing my doctor said - denied, didn't use official appeal form. I submitted the official form - denied, now they required more info from the doctor. We gave up on that one and found an ok alternative.

I went to an eye specialist. Their website showed the provider and the facility were in network. Claim denied - provider not covered. I called and spoke to a rep who acknowledged the provider was in network and "it's really weird" that they denied they claim. They were completely useless in solving the problem. I submitted an official appeal, two months later I get a letter basically saying "our bad, that provider is covered, we'll pay them."

I needed a minor surgical procedure done. Claim denied - procedure not preauthorized. I have a letter from them showing the procedure was preauthorized three weeks before the claim. This was after the preauthorization was initially denied and I had to appeal that decision and my doctor had to send in more documentation. I called and another useless rep stated they saw the preauthorization and would submit it for processing. One month later, claim still denied. Official appeal is still in process on that one.

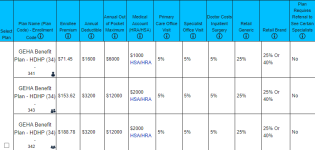

I had been a big supporter of GEHA. Once you hit the deductible, the 5% copay is amazing. But with all the headaches of trying to get them to pay for claims this year, I'm going somewhere else.