Acquired Taste

Forum Sage

- Messages

- 1,026

Y’all need to be in MPC before it rockets back to $44. 8 percent dividend as well. I’m all in on this one.View attachment 4889

In at .97, out at 1.35. +$4.2k. Idk why I ever fuck with options, pennies are way more fun.

Oil is dead my guy. Besides, if it doesn't have a chance of being a 10 bagger in one day, I'm out. I'm tryna get serious tendies on the reg, you feel me bro?Y’all need to be in MPC before it rockets back to $44. 8 percent dividend as well. I’m all in on this one.

I was in MRO @ $3.95 then the POTUS tweeted and I panic sold at $4.13. I should’ve kept it as if he up 11.1%. I’m glad I didn’t sell XOM though. I’m up 4.9% in it from last week.Y’all need to be in MPC before it rockets back to $44. 8 percent dividend as well. I’m all in on this one.

The way CCL is going up as they announce more cancelled cruises, layoffs, and trying to sell ships... It feels like a pump before the dump. I was in @ $15 and then sold @ $15.71 right after POTUS’s exceptional tweet.I'm gonna yolo 10k into CCL 35c 4/16 about 2 weeks before the election

Yea I hopped on the MRO train when it was @$4 and been doing well with it. Going to hold for now. Also, took CCL around $16.The way CCL is going up as they announce more cancelled cruises, layoffs, and trying to sell ships... It feels like a pump before the dump. I was in @ $15 and then sold @ $15.71 right after POTUS’s exceptional tweet.

What’s your thesis on oil is dead? Most cars on the road are still gas. Airplanes are still flying. We will rely on oil for quite some time IMO. We lack the technology and resources to go 100 percent green. I personally think MPC is super undervalued and will rack in my 8 percent dividend every year. I also sell covered calls on my position to boost returns. I’m not trying to hit a home run because most of the time you’ll strike out. Just base hits. Double my account every 2 years. Using margin carefully to increase yields and returns. You can use margin safely by selling covered calls and taking the premium you receive to buy puts. That way if your position does turn the wrong way you’re protected in some way.Oil is dead my guy. Besides, if it doesn't have a chance of being a 10 bagger in one day, I'm out. I'm tryna get serious tendies on the reg, you feel me bro?

Sure we will still be oil dependent for years to come, but demand is way down and supply is still high. Pre-covid, oil production was at all time highs I believe as a result of the fracking boom. The excess supply was already keeping prices supressed around $60 a barrel when it had been up at $150 a decade earlier. Obviously covid just crushed demand even further. The WFH movement as well as the massive layoffs and unemployment numbers reduced gas demand as commuting to work decreased. Air travel and cruising is still extremely depressed. The push to EV is being embraced more and more. Look at Commiefornia moving to ban sales of gas cars by 2035. The economy is in shambles and the "recovery" is completely dependent on printing ever more money at the Fed and dropping it out of helicopters. Even the oil industry recognizes it's in trouble. BP and Shell already cut their dividends and analysts say more oil companies will follow. The only scenario that I think really increases the price of oil is hyperinflation or stagflation, in which case there are better hedges to bet on. While it's smart to sell covered calls, I don't really like to mess around with too much hedging because I'm greedy and want to maximize my profits. Selling calls and using the premium to buy puts doesn't sound very efficient though, but what the hell do I know?What’s your thesis on oil is dead? Most cars on the road are still gas. Airplanes are still flying. We will rely on oil for quite some time IMO. We lack the technology and resources to go 100 percent green. I personally think MPC is super undervalued and will rack in my 8 percent dividend every year. I also sell covered calls on my position to boost returns. I’m not trying to hit a home run because most of the time you’ll strike out. Just base hits. Double my account every 2 years. Using margin carefully to increase yields and returns. You can use margin safely by selling covered calls and taking the premium you receive to buy puts. That way if your position does turn the wrong way you’re protected in some way.

Sure we will still be oil dependent for years to come, but demand is way down and supply is still high. Pre-covid, oil production was at all time highs I believe as a result of the fracking boom. The excess supply was already keeping prices supressed around $60 a barrel when it had been up at $150 a decade earlier. Obviously covid just crushed demand even further. The WFH movement as well as the massive layoffs and unemployment numbers reduced gas demand as commuting to work decreased. Air travel and cruising is still extremely depressed. The push to EV is being embraced more and more. Look at Commiefornia moving to ban sales of gas cars by 2035. The economy is in shambles and the "recovery" is completely dependent on printing ever more money at the Fed and dropping it out of helicopters. Even the oil industry recognizes it's in trouble. BP and Shell already cut their dividends and analysts say more oil companies will follow. The only scenario that I think really increases the price of oil is hyperinflation or stagflation, in which case there are better hedges to bet on. While it's smart to sell covered calls, I don't really like to mess around with too much hedging because I'm greedy and want to maximize my profits. Selling calls and using the premium to buy puts doesn't sound very efficient though, but what the hell do I know?

Bro I'm all for oil futures as an investment we need a good war to really get things going I'm voting china because of concentration camps

Goldman Sachs: Biden Win Is Bullish For Oil | OilPrice.com

A Joe Biden win at next month’s U.S. elections will likely be an upward catalyst for oil prices according to Goldman Sachsoilprice.com

iphone reveal was priced in lolWhy is my apple stonk down today after the iPhone reveal wtf ??

Cus if Apple doesn’t announce a cure for cancer it goes down. Till they sell a billion of them then it goes up.Why is my apple stonk down today after the iPhone reveal wtf ??

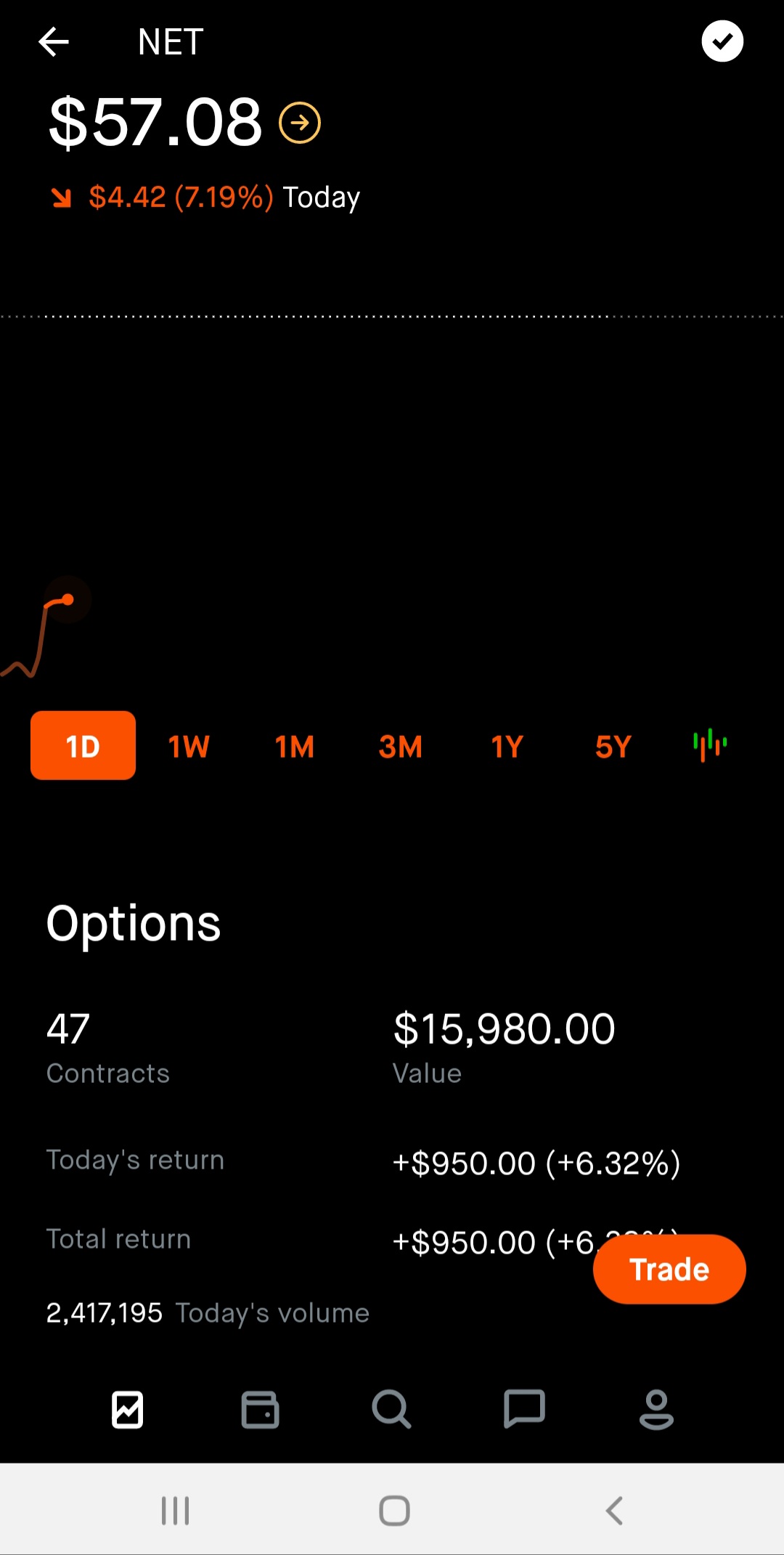

i feel like the boat on cloudflare has already sailed...you guys wanna make money?

FSLY and NET calls tomorrow. make em monthlies at least

go look at today's aftermarket charts for those tickers and figure out why they are the way they arei feel like the boat on cloudflare has already sailed...

go look at today's aftermarket charts for those tickers and figure out why they are the way they are

I'm dropping 15k on NET 60c 11/20 at open tomorrow. will take a look at maybe doing FSLY instead depending on how premarket looks for these 2 tomorrow

I’ll tell you what positions I’m holding:Today I bought:

WYNN @ $71.63

LVS @ $46.22

MRO @ $3.95

XOM @ $33.26

BAYZF @ $54.90

BUD @ $53.52

What positions are you guys holding this week?