Peter Gibbons

Legendary Member

- Messages

- 2,158

My understanding is that bubble is about to burst again. Not to epic 2008 proportions but it's set for a dip.Real estate

My understanding is that bubble is about to burst again. Not to epic 2008 proportions but it's set for a dip.Real estate

Just because I take medical advice from a Tractor Supply sales associate doesn’t make me any lesserYeah but that’s like pro bono and totally your opinion

Everyone should just do their own research, can’t trust scientists that agree on thingsJust because I take medical advice from a Tractor Supply sales associate doesn’t make me any lesser

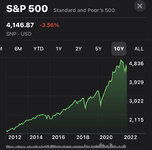

Anyone that kept buying during 2008 or Covid or any recession really has come out better over the long run.Politics aside:

- Nasdaq/stocks down

- Crypro down

- TSP/401K losses

- Fed raising interests by .50%

Curious to see what the smart investors on here would do? I know 32andBelow mentioned buying the dip. Any other thoughts?

Max out TSP, limit purchasing in more liquid stock accounts. Shit is going to hit the fan in several ways in the next few years but in the long, long run it's always a bull market.Politics aside:

- Nasdaq/stocks down

- Crypro down

- TSP/401K losses

- Fed raising interests by .50%

Curious to see what the smart investors on here would do? I know 32andBelow mentioned buying the dip. Any other thoughts?

Not this time brother. This time is different. Only 2 outcomes and neither one is good. Either we return to sound money and the debt party comes to an end, government reigns in the spending and cuts entitlements, raises taxes and still defaults on a lot of its obligations because we are literally insolvent...... or the more likely and politically viable option where at the first sign of pain, they turn the printer back on and put it into hyperdrive which coincidentally results in hyperinflation and we all get fucked when the dollar is quite literally worthless. Yeah there will be a bull market on paper when that happens, but all that paper "wealth" will mean nothing when you can't buy shit with it. The party is over. Time to sober up and prepare for the worst hangover in the history of the world.Max out TSP, limit purchasing in more liquid stock accounts. Shit is going to hit the fan in several ways in the next few years but in the long, long run it's always a bull market.

The difference here is there being a safe, publicly available alternative that is widely available in all states to all segments of the public so you don't have to take the horse medicine to get the possibly life saving treatment you need vs that now becoming illegal and the only option for some being said horse medicine.

Yes there is certainly irony there at the surface level, but if you put an ounce of thought into it, it stops there.

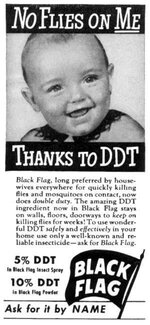

People made fun of the Q crowd for taking ivermectin because it’s an antiparisitic

Ironically the most correct thing about your post, but you’re clearly talking about yourself.Your ignorance is showing

It was just made up the ivermectin worked against Covid. How do you not understand that. No one made up that the other drug worked against babies.That surface level irony is the point. Both drugs clearly have human uses, but even with ivermectin’s many human uses, it was still branded as horse dewormer.

One of those “safe, publicly available alternatives” seems to have had those broad, question-it-and-be-canceled-forever labels revoked as of today, too, as someone just pointed out. Funny how that works.

View attachment 7686

I’m going to stop you right there before you rewrite history. The attacks didn’t have to do with the use, it had to do with taking what was widely labeled as “horse dewormer.” Don’t you remember the Rogan dustup about this?

Ironically the most correct thing about your post, but you’re clearly talking about yourself.

Also no one would care if you took ivermectin for an actual human use

This is what I hear too, but also that the housing market won’t dip much because it’s not the same scenario with the banks as of 08. Interest rates going up might drop the prices of the homes, but who knows.My understanding is that bubble is about to burst again. Not to epic 2008 proportions but it's set for a dip.

I have heard of VTSAX before. Maybe I’ll open a T Rowe acct, unless you recommend a better company. Last 2 years I’ve been close to maxing out, this year should be the same. I opened an IRA through a credit union last year and put the $6K and another $6K this year, can I still open an index fund?find a s&p500 index fund. Example: VTSAX

Low cost, just like the C fund in the TSP. If you’re making 120k+ you should be maxing tsp and an individual IRA. You can invest in index funds through IRAs too.

An index fund is just something you can buy. An IRA is a kind of tax-advantaged account like the TSP/401k is a kind of tax-advantaged account—you can open a TSP and leave everything in cash or buy just the G fund or buy the C fund, which is an index fund. And you can open a non-tax-advantaged brokerage account and buy index funds within that account too.I have heard of VTSAX before. Maybe I’ll open a T Rowe acct, unless you recommend a better company. Last 2 years I’ve been close to maxing out, this year should be the same. I opened an IRA through a credit union last year and put the $6K and another $6K this year, can I still open an index fund?

You can buy an index fund inside your ira. You but it the same way you’d buy a stockI have heard of VTSAX before. Maybe I’ll open a T Rowe acct, unless you recommend a better company. Last 2 years I’ve been close to maxing out, this year should be the same. I opened an IRA through a credit union last year and put the $6K and another $6K this year, can I still open an index fund?

It doesn’t work against Covid lmfao how dense are you guys

Imagine memeing about women losing access to health care. Pretty sick

Imagine having zero good takes so you just constantly post logic wikisAppeal to emotion - Wikipedia

en.m.wikipedia.org

Access to Healthcare eh? I think that is the stupidest argument out there. Call it what it is, I oopsied and don't want to take care of this thing so I am going to kill it. Actual medically necessary abortions are the minority by a long shot. Rape/incest is less than 1%. Don't try and change the language to make yourself feel better.Imagine memeing about women losing access to health care. Pretty sick