dingalings99

Trusted Contributor

- Messages

- 190

Hello everyone,

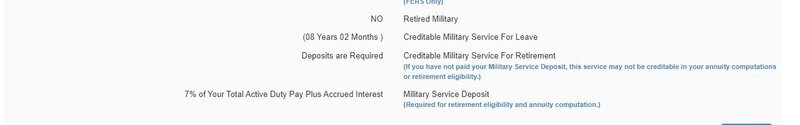

I recently checked out so I'm in the process of getting all my stuff together to buy back the time. I was looking at the "fed employees benefits statement" on employee express and saw that I'd have to pay 7% of my pay which went against the 3% that I had been seeing from doing research. I did some digging and apparently CSRS retirement plan people pay 7% and FERS pays 3%. What's the difference between these two plans and which one is better?

On my LES the deductions are towards FERS/FRAE so does that mean this is some clerical error; either I'm CSRS and the LES has been wrong for the deduction type or I'm FERS and the buyback should be 3% instead of 7%?

Thanks

I recently checked out so I'm in the process of getting all my stuff together to buy back the time. I was looking at the "fed employees benefits statement" on employee express and saw that I'd have to pay 7% of my pay which went against the 3% that I had been seeing from doing research. I did some digging and apparently CSRS retirement plan people pay 7% and FERS pays 3%. What's the difference between these two plans and which one is better?

On my LES the deductions are towards FERS/FRAE so does that mean this is some clerical error; either I'm CSRS and the LES has been wrong for the deduction type or I'm FERS and the buyback should be 3% instead of 7%?

Thanks