GulfBravoPapa

⭐SuperStar

- Messages

- 2,120

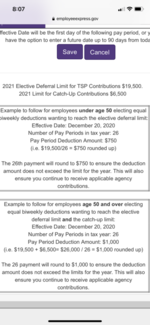

2019 TSP contribution limits will be $19,000. TSP: Contribution Limits

There is some debate if that should be $730 or $731 per pay period. I think it should be $731 with pay period 26 being $6 less while the TSP website lists it as $730 per pay period. ($730 x 26 = $18,980). Catch up contribution limit is still $6,000.

You can update your TSP contributions at this time with a future date.

There is some debate if that should be $730 or $731 per pay period. I think it should be $731 with pay period 26 being $6 less while the TSP website lists it as $730 per pay period. ($730 x 26 = $18,980). Catch up contribution limit is still $6,000.

You can update your TSP contributions at this time with a future date.