- Messages

- 3,040

- Facility

- Command Center

Good Morning Lads,

Given the recent trends combined with hysteria in the market (of which I will readily admit I am not an expert) has really triggered an interest in my TSP and retirement these past two months, thus leading me to “Seasonal Investing.” To start with a few things to make a note of so that you take what I say with a grain of salt and plan on your own accord:

-The following group to be mentioned is made entirely of individuals who do not claim to be a professional investment advisory group, just regular TSP investors that discuss and share information

-It is important to keep in mind that YOUR TSP balance CAN and WILL go down at times no matter what you invest in

-Always, to the maximum extent possible, educate yourself and never rely on others because at the end of the day it is YOUR money and retirement

TSP For Beginners (YouTube Video)

TSP Seasonal Strategies (FacebookGroup)

You will have to apply to join the group, answer a few basic questions, and not be a complete twat. Point of order, LEAVE POLITICS AT THE DOOR.

TSP Center Introductory Post on Seasonal Strategies (Forum)

This is a segment taken from the introductory post on Seasonal Strategies:

Pros:

- Emotion is removed from the decision making process. Everything is analyzed logically by establishing quantified limitations of what a “good” month looks like, what the odds are of having a positive month vs the likelihood of a month being negative. Don't be fooled, you will still feel the emotion, but if you can keep it out of the decision making process then this is a plus.

- It’s a systematic approach that analyzes the data and makes adjustments as necessary. You don’t blindly follow the system, you understand “why” you’re in a certain Fund at a certain time and have factual data to support that understanding.

- It tends to produce consistent returns because you avoid the times of year when bad things often happen, and you make sure you’re invested when the good things usually happen.

- It’s simple to do: only about 6 moves a year for most plans, some a few more, some less. Either way, it’s a system that fits easily into the TSP’s restrictions on allowing only 2 IFT moves each month. In addition, you don’t base your moves on any fancy market indicators or some market guru’s opinion. You don’t use anything more than a simple statistical look at historical returns. KISS is the idea here.

Cons:

- If you commit to the strategy, you must follow through with it and ride the emotions that come with rough times. I made the mistake of not doing so in Feb 2014. The market took a short dive in late Jan / early Feb while I was in the S Fund. I got scared and ran to the F Fund for the duration of Feb because the F Fund is the second-best Fund for that month. While that Feb ’14 was positive for the F fund (0.62%), the S Fund came back strong later in the month and had a return of 5.43%. This mistake on my part made a big difference in my ’14 return. I further compounded the problem when I went looking for an indicator to keep me from losing again – a “stop loss” trigger of sorts. That indicator ended up failing me because I didn’t fully understand it until I did a lot of digging and research. Before I could finish my learning, the indicator caused even more losses for me in Oct 2014, after which I finally figured out why the indicator didn’t work the way I thought it did. Fear caused me to leave the system, not once but twice, and it cost me dearly. I’ve learned my lesson: follow the data, trust the numbers. The Law of Averages works.

- No system works all of the time. Sometimes it just won’t work. We’re playing the odds with this strategy, and while the Law of Averages says we should win in the long run, it also says that we’ll have periods when we don’t. What we’re doing is stacking the deck in our favor and making an informed decision on where and when we invest. It’s the long-term end result you need to keep your focus on, not the short term dips and peaks. Followers of Bogle’s philosophy can appreciate this sentiment.

- Times when the markets move sideways for a long time are frustrating to this system because we’re looking for clear positives and negatives for each time period we use to make our decisions. At such times, we have to resist the urge to try to play Market Timer in an effort to try to do better. You avoid doing this temptation by remembering that a small positive is still a positive, and a small negative could be much worse if we aren’t good at our market timing decisions.

TSPCalc ($20 a year if you subscribe)

This is a TSP Calculator that comes with a variety of strategies (Jerin, Larry, Matt, etc…) that you may select to see the:

-CAGR (Compound Annual Growth Rate), or even create your own strategy

-Mean

-Standard Deviation

-A whole host of charts, graphs, etc…

It should be noted that the subscription is $20 a year and includes two very important things:

-SMS messages AFTER you select a strategy telling you when to execute and Interfund Transfer

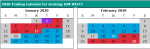

-Trading Calendar for 2020 that tells you what day of the month to execute your Interfund Transfer

Here is a screenshot of the last two months, the Purple denotes the I Fund, Blue the S Fund, Red the F Fund. The days in white are "trading days" for your two IFT's.

How To #1: The Seasonal Calculator

How To #2: The Seasonal Builder

TSPCalc YouTube Channel

Apparently I have a knack for combining a variety of documents into a “cheat sheet” so this a very basic attempt to provide information (more will be provided in links as you continue to read) to you in the spirit that .65 was born by our High Supreme Overlord MJ. Shoutout to the one FLM (you know who you are so approve my credit) I know who constantly checks .65 that I work with.

TSP Basic Terms/Funds

Interfund Transfers (IFT) *Limit 2 a month* - An IFT allows you to redistribute all or part of your existing TSP account among the different TSP funds. An IFT does not affect the investment of future deposits into your TSP account.

IFTs made on TSP.GOV or the ThriftLine (1-877-968-3778) before 12 noon Eastern time are generally processed as of that business day. Requests made after 12 noon Eastern time are generally processed the next business day.

Contribution Allocations (CA) *Unlimited reallocation's a month* - Your contribution allocation tells us how you want new money going into your account to be invested among the TSP investment fund options. New money may be your own contributions, your agency/service contributions (if you are a FERS or BRS participant), your TSP loan payments, and any transferred or rollover funds from other retirement plans. You can make a contribution allocation at any time.

Your contribution allocation will not affect the money that is already in your account. To manage those funds, visit Interfund Transfers. For more information, view our Changing How You're Invested video.

Your contribution allocation will remain in effect until you submit another contribution allocation request.

If you have a traditional balance and a Roth balance in your TSP account, you cannot make a separate contribution allocation for each balance.

Any new money will be deposited proportionally according to your fund allocation at the time the money is deposited into your TSP account.

C Fund - The objective of the C Fund is to match the performance of the Standard & Poor’s 500 Stock Index (S&P 500), a broad market index made up of stocks of 500 large to medium-sized U.S. companies. There is a risk of loss if the S&P 500 declines in response to changes in overall economic conditions (market risk).

https://www.tsp.gov/PDF/formspubs/F...4TqG_AKaxq_u4QMU5tSRwl_mAyBTIMezgb6mfwT8mES3w

S Fund - The objective of the S Fund is to match the performance of the Dow Jones U.S. Completion Total Stock Market (TSM) Index, a broad market index made up of stocks of U.S. companies not included in the S&P 500 Index. There is a risk of loss if the Dow Jones U.S. Completion TSM Index declines in response to changes in overall economic conditions (market risk).

https://www.tsp.gov/PDF/formspubs/F...mPgtbnSJ688kzB3mFj8LdbIDZ6wMBAfkUGlopXSq4G7S0

I Fund - The objective of the I Fund is to match the performance of the MSCI EAFE (Europe, Australasia, Far East) Index. There is a risk of loss if the EAFE Index declines in response to changes in overall economic conditions (market risk) or in response to increases in the value of the U.S. dollar (currency risk).

https://www.tsp.gov/PDF/formspubs/F...k8v4aQ2dyaaNVZIkVc_BI8DJnjfgK-0f_0aA3g52S1BVg

G Fund- The G Fund's investment objective is to produce a rate of return that is higher than inflation while avoiding exposure to credit (default) risk and market price fluctuations. The G Fund is subject to inflation risk, or the possibility that your G Fund investment will not grow enough to offset the reduction in purchasing power that results from inflation.

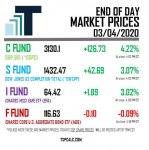

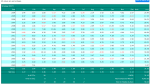

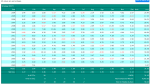

For those wondering what the TSP Calculator looks like, what strategy I am following, what the returns and standard deviation are, here is a screenshot:

Please note that I cannot take credit for any of this, much brighter minds have put this together. There is quite a bit more reading to truly understand what you are embarking on should you decide to delve further and take the plunge yourself but this is a very brief and basic synopsis of Seasonal Strategies and the different TSP funds. I spent almost an entire Sunday doing research, reading, watching videos on it. I wish I had this information back when I first started with Homeland Security. You have been pointed in the right direction... the choice is, as they say, up to you. My return last year before I started doing this was 18%, for the last two months combined it has equated to 7.15%... Research and Discuss comrades.

-GC

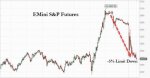

*February Update 2/28/2020 (Video)

Given the recent trends combined with hysteria in the market (of which I will readily admit I am not an expert) has really triggered an interest in my TSP and retirement these past two months, thus leading me to “Seasonal Investing.” To start with a few things to make a note of so that you take what I say with a grain of salt and plan on your own accord:

-The following group to be mentioned is made entirely of individuals who do not claim to be a professional investment advisory group, just regular TSP investors that discuss and share information

-It is important to keep in mind that YOUR TSP balance CAN and WILL go down at times no matter what you invest in

-Always, to the maximum extent possible, educate yourself and never rely on others because at the end of the day it is YOUR money and retirement

TSP For Beginners (YouTube Video)

TSP Seasonal Strategies (FacebookGroup)

You will have to apply to join the group, answer a few basic questions, and not be a complete twat. Point of order, LEAVE POLITICS AT THE DOOR.

TSP Center Introductory Post on Seasonal Strategies (Forum)

This is a segment taken from the introductory post on Seasonal Strategies:

Pros:

- Emotion is removed from the decision making process. Everything is analyzed logically by establishing quantified limitations of what a “good” month looks like, what the odds are of having a positive month vs the likelihood of a month being negative. Don't be fooled, you will still feel the emotion, but if you can keep it out of the decision making process then this is a plus.

- It’s a systematic approach that analyzes the data and makes adjustments as necessary. You don’t blindly follow the system, you understand “why” you’re in a certain Fund at a certain time and have factual data to support that understanding.

- It tends to produce consistent returns because you avoid the times of year when bad things often happen, and you make sure you’re invested when the good things usually happen.

- It’s simple to do: only about 6 moves a year for most plans, some a few more, some less. Either way, it’s a system that fits easily into the TSP’s restrictions on allowing only 2 IFT moves each month. In addition, you don’t base your moves on any fancy market indicators or some market guru’s opinion. You don’t use anything more than a simple statistical look at historical returns. KISS is the idea here.

Cons:

- If you commit to the strategy, you must follow through with it and ride the emotions that come with rough times. I made the mistake of not doing so in Feb 2014. The market took a short dive in late Jan / early Feb while I was in the S Fund. I got scared and ran to the F Fund for the duration of Feb because the F Fund is the second-best Fund for that month. While that Feb ’14 was positive for the F fund (0.62%), the S Fund came back strong later in the month and had a return of 5.43%. This mistake on my part made a big difference in my ’14 return. I further compounded the problem when I went looking for an indicator to keep me from losing again – a “stop loss” trigger of sorts. That indicator ended up failing me because I didn’t fully understand it until I did a lot of digging and research. Before I could finish my learning, the indicator caused even more losses for me in Oct 2014, after which I finally figured out why the indicator didn’t work the way I thought it did. Fear caused me to leave the system, not once but twice, and it cost me dearly. I’ve learned my lesson: follow the data, trust the numbers. The Law of Averages works.

- No system works all of the time. Sometimes it just won’t work. We’re playing the odds with this strategy, and while the Law of Averages says we should win in the long run, it also says that we’ll have periods when we don’t. What we’re doing is stacking the deck in our favor and making an informed decision on where and when we invest. It’s the long-term end result you need to keep your focus on, not the short term dips and peaks. Followers of Bogle’s philosophy can appreciate this sentiment.

- Times when the markets move sideways for a long time are frustrating to this system because we’re looking for clear positives and negatives for each time period we use to make our decisions. At such times, we have to resist the urge to try to play Market Timer in an effort to try to do better. You avoid doing this temptation by remembering that a small positive is still a positive, and a small negative could be much worse if we aren’t good at our market timing decisions.

TSPCalc ($20 a year if you subscribe)

This is a TSP Calculator that comes with a variety of strategies (Jerin, Larry, Matt, etc…) that you may select to see the:

-CAGR (Compound Annual Growth Rate), or even create your own strategy

-Mean

-Standard Deviation

-A whole host of charts, graphs, etc…

It should be noted that the subscription is $20 a year and includes two very important things:

-SMS messages AFTER you select a strategy telling you when to execute and Interfund Transfer

-Trading Calendar for 2020 that tells you what day of the month to execute your Interfund Transfer

Here is a screenshot of the last two months, the Purple denotes the I Fund, Blue the S Fund, Red the F Fund. The days in white are "trading days" for your two IFT's.

How To #1: The Seasonal Calculator

How To #2: The Seasonal Builder

TSPCalc YouTube Channel

Apparently I have a knack for combining a variety of documents into a “cheat sheet” so this a very basic attempt to provide information (more will be provided in links as you continue to read) to you in the spirit that .65 was born by our High Supreme Overlord MJ. Shoutout to the one FLM (you know who you are so approve my credit) I know who constantly checks .65 that I work with.

TSP Basic Terms/Funds

Interfund Transfers (IFT) *Limit 2 a month* - An IFT allows you to redistribute all or part of your existing TSP account among the different TSP funds. An IFT does not affect the investment of future deposits into your TSP account.

IFTs made on TSP.GOV or the ThriftLine (1-877-968-3778) before 12 noon Eastern time are generally processed as of that business day. Requests made after 12 noon Eastern time are generally processed the next business day.

Contribution Allocations (CA) *Unlimited reallocation's a month* - Your contribution allocation tells us how you want new money going into your account to be invested among the TSP investment fund options. New money may be your own contributions, your agency/service contributions (if you are a FERS or BRS participant), your TSP loan payments, and any transferred or rollover funds from other retirement plans. You can make a contribution allocation at any time.

Your contribution allocation will not affect the money that is already in your account. To manage those funds, visit Interfund Transfers. For more information, view our Changing How You're Invested video.

Your contribution allocation will remain in effect until you submit another contribution allocation request.

If you have a traditional balance and a Roth balance in your TSP account, you cannot make a separate contribution allocation for each balance.

Any new money will be deposited proportionally according to your fund allocation at the time the money is deposited into your TSP account.

C Fund - The objective of the C Fund is to match the performance of the Standard & Poor’s 500 Stock Index (S&P 500), a broad market index made up of stocks of 500 large to medium-sized U.S. companies. There is a risk of loss if the S&P 500 declines in response to changes in overall economic conditions (market risk).

https://www.tsp.gov/PDF/formspubs/F...4TqG_AKaxq_u4QMU5tSRwl_mAyBTIMezgb6mfwT8mES3w

S Fund - The objective of the S Fund is to match the performance of the Dow Jones U.S. Completion Total Stock Market (TSM) Index, a broad market index made up of stocks of U.S. companies not included in the S&P 500 Index. There is a risk of loss if the Dow Jones U.S. Completion TSM Index declines in response to changes in overall economic conditions (market risk).

https://www.tsp.gov/PDF/formspubs/F...mPgtbnSJ688kzB3mFj8LdbIDZ6wMBAfkUGlopXSq4G7S0

I Fund - The objective of the I Fund is to match the performance of the MSCI EAFE (Europe, Australasia, Far East) Index. There is a risk of loss if the EAFE Index declines in response to changes in overall economic conditions (market risk) or in response to increases in the value of the U.S. dollar (currency risk).

https://www.tsp.gov/PDF/formspubs/F...k8v4aQ2dyaaNVZIkVc_BI8DJnjfgK-0f_0aA3g52S1BVg

G Fund- The G Fund's investment objective is to produce a rate of return that is higher than inflation while avoiding exposure to credit (default) risk and market price fluctuations. The G Fund is subject to inflation risk, or the possibility that your G Fund investment will not grow enough to offset the reduction in purchasing power that results from inflation.

For those wondering what the TSP Calculator looks like, what strategy I am following, what the returns and standard deviation are, here is a screenshot:

Please note that I cannot take credit for any of this, much brighter minds have put this together. There is quite a bit more reading to truly understand what you are embarking on should you decide to delve further and take the plunge yourself but this is a very brief and basic synopsis of Seasonal Strategies and the different TSP funds. I spent almost an entire Sunday doing research, reading, watching videos on it. I wish I had this information back when I first started with Homeland Security. You have been pointed in the right direction... the choice is, as they say, up to you. My return last year before I started doing this was 18%, for the last two months combined it has equated to 7.15%... Research and Discuss comrades.

-GC

*February Update 2/28/2020 (Video)

Last edited: