I.DO.VEHCTAHS

Active Member

- Messages

- 62

Pretty sure that’s exactly what I said using different words.I’ve said this before, the congressional pay ceiling is only a factor for your retirement.

They could make the 1.6% a year 10% a year, you’d hit the ceiling after three years, and you’d be getting a 10% lump sum every single year. Hitting the cap year three would monumentally increase your lifetime earnings not to mention the 21k lump sum everyone at the cap would see every June.

They could make it a 50% raise every June which in turn just becomes a 50% bonus paid out every year.

We’re really not capped at the congressional limit.

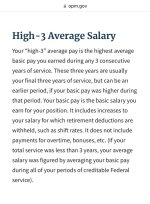

Article highlighted for clarity. Lump sum payment.

The only down side to bonus after bonus after bonus is that you are creating a bunch of employees dependent upon an income that their retirement will come nowhere near to reflecting. And I’m not saying I’m opposed to any kind of bonus…just stating the facts of the long term impact of bonuses. I’d personally like to see something that impacts my retirement income as well.